IN SF 51413 2007-2025 free printable template

Show details

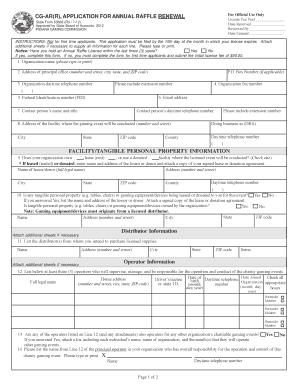

CG-EN EXEMPT EVENT NOTIFICATION State Form 51413 R3 / 07-07 INDIANA GAMING COMMISSION INSTRUCTIONS You must file this application by March 1 or least one 1 week before your first exempt event. Please attach documents. Name of Qualified Organization Street Address City State Zip Code County Name of Contact Person Daytime Telephone Number A qualified organization is not required to obtain a license from The Commission but is required to send notification if the value of all prizes at the event...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana charity gaming forms

Edit your indiana gaming license application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to get a gaming license in indiana form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gaming license indiana online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indiana gambling license form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how do you get a gaming license in indiana form

How to fill out IN SF 51413

01

Obtain a blank IN SF 51413 form from the designated source.

02

Fill in the applicant's name in the designated section at the top of the form.

03

Provide the applicant's address, including street, city, state, and zip code.

04

Enter the contact number of the applicant to ensure communication is possible.

05

Specify the purpose of the application clearly in the appropriate section.

06

Include any relevant details or information requested on the form.

07

Review the form to ensure all information is accurate and complete.

08

Sign and date the form at the bottom where indicated.

09

Submit the completed form as per the submission guidelines provided.

Who needs IN SF 51413?

01

Individuals or organizations applying for specific government programs or benefits that require the IN SF 51413 form.

Fill

level 4 gaming license indiana

: Try Risk Free

People Also Ask about indiana charity gaming license

How do I start selling pull tabs?

In most cities, persons selling pull tabs must be licensed. This requires applying for and obtaining a pull-tab sales license with the city clerk. Selling pull tabs without first procuring an annual license is illegal (whether operating as a vendor or as an individual).

How do you get a gambling license in Indiana?

The Commission does not offer a statewide license. Instead, the Commission issues Occupational Licenses at each , Supplier, and/or SWV. In order to apply for an Indiana Occupational License, an individual must first have an offer of employment from an Indiana , Supplier, or SWV.

How much is a raffle license in Indiana?

Initial Registration Agency:Indiana Gaming CommissionForm:Form CG-AR: Annual Raffle License ApplicationAgency Fee:$50

How much does a gaming license cost in Indiana?

Registration Renewal Agency:Indiana Gaming CommissionForm:Form CG-ADP (R): Annual Door Prize Renewal ApplicationAgency Fee:Renewal fees are based on adjusted gross income from gaming events. The minimum fee is $50, maxiumum fee is $26,000.Due:Annually by the 10th day of the month before the month of issuance.

How much does it cost to get a gaming license in Indiana?

The permanent license fees are as follows: Level 1 License: $100.00. Level 2 License: $50.00. Level 3 License: $25.00.

How to file a complaint with the Indiana Gaming Commission?

You can remain anonymous. Members of the public can report criminal activity and any other violations regarding individuals or companies under the jurisdiction of the Indiana Gaming Commission as follows: Call: 1(866) 610-TIPS(8477) to leave a message.

How much is a raffle license in Indiana?

License Fee Information The license fee for the first Raffle License is $25.

Do you need a license to sell pull tabs in Indiana?

All business entities desiring to manufacture, distribute, or sell the following items in Indiana must be licensed by the Indiana Department of Revenue. These items include bingo sheets, devices, equipment, and other supplies used in playing bingo, as well as pull tabs, punchboards and tip boards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit level 2 gaming license indiana in Chrome?

indiana gaming license can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the how much is a gaming license in indiana in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your indiana gaming license search in minutes.

How do I edit indiana non profit gaming license on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share indiana gaming commission license from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is IN SF 51413?

IN SF 51413 is a form used for specific reporting purposes by certain individuals or organizations, often related to financial or operational disclosures.

Who is required to file IN SF 51413?

Entities or individuals who engage in activities mandated by regulatory bodies, typically those involved in financial transactions or operations requiring oversight, must file IN SF 51413.

How to fill out IN SF 51413?

To fill out IN SF 51413, follow the instructions provided with the form, ensuring to complete all required sections accurately and provide necessary supporting documents.

What is the purpose of IN SF 51413?

The purpose of IN SF 51413 is to collect and standardize information required for compliance and regulatory oversight, ensuring transparency and accountability within specified activities.

What information must be reported on IN SF 51413?

IN SF 51413 typically requires reporting of financial data, operational details, and other relevant information as specified by the regulatory authority overseeing the form.

Fill out your IN SF 51413 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Gaming License Requirements is not the form you're looking for?Search for another form here.

Keywords relevant to indiana gaming license cost

Related to indiana raffle license

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.